Elections: More Buzz Than Bite

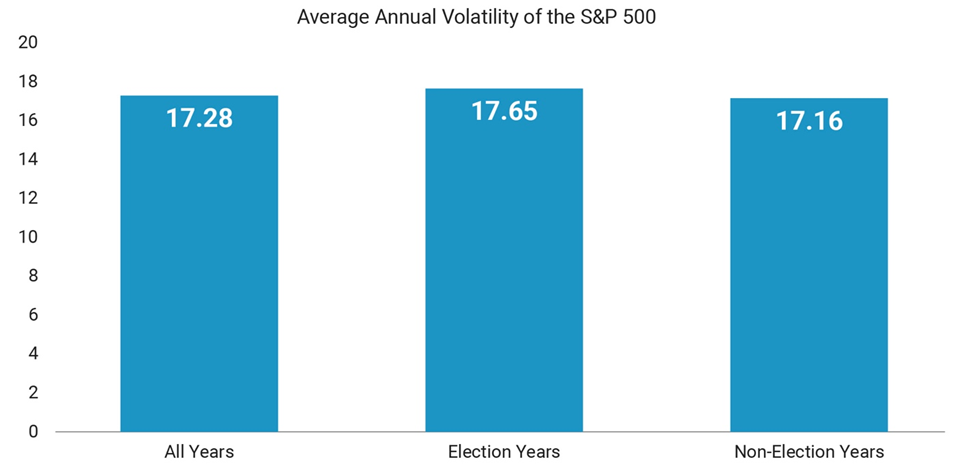

As elections approach, media noise and investor anxiety often rise, but historical data shows that market volatility in election years is nearly identical to non-election years. Markets tend to focus on fundamentals like interest rates, earnings, and inflation rather than political events.

Elections may generate headlines, but they rarely have lasting impacts on overall market performance. We remain focused on long-term strategies and risk management while seeking to avoid reacting to election-related noise.

Elections: More Buzz Than Bite

Source: Bloomberg, Redwood. Data as of 10/7/2024. Date Range from 12/31/1929 - 12/31/2023.

Regards,

Allgood Financial

Disclosure: This piece is for informational purposes only and contains opinions of Redwood that should not be construed as facts. Information provided herein from third parties is obtained from sources believed to be reliable, but no representation or warranty is made as to its accuracy or completeness. Charts and graphs are for illustrative purposes only. Discussion of any specific strategy is not intended as a guarantee of profit or loss. Past performance is not a guarantee of future results. The objectives mentioned are not guaranteed to be achieved. Investors cannot invest directly in any of the indices mentioned above. Diversification of asset class is not a guarantee against loss.

5313 Anchorage Drive | Nashville, TN 37220| 331.229.3224 | matthew@allgoodfin.com | allgoodfin.com